What is a jumbo loan? As its name suggests, a jumbo mortgage is a mortgage that’s larger than the typical home loan, more often referred to as a conventional conforming loan. What does this mean, specifically? It entails that, even though jumbo loan credit quality requirements are typically higher than that of a conventional loan, […]

Types of Mortgage

New 3 Percent Down Mortgage Loans for 2015

As anyone who’s ever been remotely interested in purchasing a home knows, a down payment is a form of securing a loan with money you’ve previously saved. The 3 percent down mortgage is typically the lowest down payment on the US market, with FHA loans requiring a 3.5 percent down payment. The bigger the down […]

VA Loans and VA Funding Fees: All You Need to Know

In the niche of mortgage loans, a VA loan is a type of credit guaranteed by the Department of Veteran Affairs (VA), available only to U.S. veterans or their surviving spouses. The terms of this type of mortgage loan are usually better than the loans available to the general population and can be accessed only […]

Understanding Second Mortgage Rates: Should You Opt for a Home Equity Loan?

Oftentimes, homeowners choose lower second mortgage rates by refinancing their initial home loan with a home equity loan. Aside from paying for a refinance, home equity loans can be used to cover for numerous big ticket expenses, such as unforeseen medical costs, university tuition, or large remodels around the house. The name of home equity […]

USDA Home Loans: The Best 0 Down Mortgage

There are several types of 0 down mortgage loans available on the market right now, for potential homebuyers who can’t afford too much down payment – or even any of it at all. Their increased availability nowadays can be attributed to the fact that the US economy is still reeling from the effects of the […]

Reverse Mortgage Solutions

Now that you know the basics on how a typical mortgage works, you may be wondering what on God’s great Earth a reverse mortgage is. According to lenders on this market segment, reverse mortgages are financial instruments that seek to provide additional welfare to retirees. This article seeks to answer a few questions regarding this […]

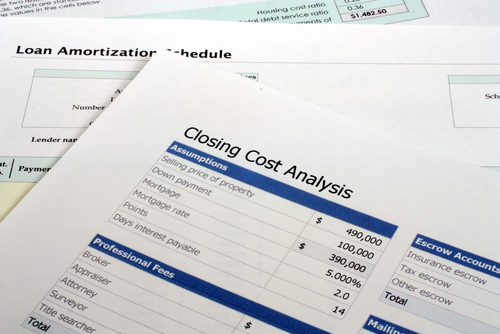

How Much Are Closing Costs on My Mortgage?

To answer your question upfront, typically closing costs will amount to anything from 2 to 5 per cent of the total purchase price of a home. Now, the same way you can get a rough idea on the total amount of loan you can afford, via an online mortgage estimator, you can also use a […]

How ‘Estimate My Mortgage’ Calculators Work

There are plenty of ‘estimate my mortgage payment’ calculators online, but some of them don’t take into account all the expenses a mortgage and a new home entail. Others only give you the monthly payments, without explaining how much goes toward the principal and how much is the interest. Finally, many of them are approximations […]