Many individuals consider where to store the down payment as they save to purchase a new home. When you try to save up 10 or 20% of a home's value, you can end up with a significant amount of cash on hand. One ideal vehicle for storing that money is a money market. The interest rates offered can vary wildly, however. We compiled a list of the best money market rates around to make your search easier.

Best Money Market Rates FAQ

1. What Is a Money Market Account?

2. Why Use a Money Market Account to Save Money?

3. How Do Money Market Rates Work?

4. Where Can You Open a Money Market?

5. How Do You Choose the Right Account with the Best Money Market Rates?

6. What Is an Annual Percentage Yield (APY)?

How We Reviewed the Best Money Market Rates

The following money markets were reviewed on the following factors: Features, Pros, Cons, and Rates. We also took fees and required deposit sizes into account to give you the answers you need to make the best choice for your situation. We focused on bank-offered money market deposit accounts and high-yield savings to ensure that your funds are FDIC insured.

Overall Range of the Best Money Market Rates

Money market rates vary from 0.05% APY to 2.25% APY. We focused our list on rates that offered rates of 1.60% yields and higher.

What We Reviewed

image | title | visit |

|---|---|---|

| Capital One 360 Money Market Account | |

| CIT Bank Money Market Account | |

| Barclays Online Savings | |

| Citizens Access Savings Account | |

| Sallie Mae Money Market Account | |

| Synchrony High Yield Savings | |

| Discover Bank Money Market Account | |

| UFB Direct Money Market Account | |

| BBVA Compass Money Market Account | |

| TIAA Bank* Money Market Account |

Capital One 360 Money Market Account

Features

If you have over $10,000 to deposit in a money market, Capital One 360 is a great option that can tie in seamlessly with your other Capital One 360 accounts. They don't require a minimum to open the account; however, the APY drops from 1.85% to 0.85% when the balance drops below $10,000. They also have no hidden fees, which can help maintain your money while you're saving for your goals.

pros

cons

Rates

1.85% APY for amounts over $10,000. 0.85% APY for amounts under $10,000. These amounts are calculated daily and are current as of November 2018.

CIT Bank Money Market Account

Features

While CIT is not at the top of our list of the best money market rates, it's 1.85% APY is nothing to scoff at. It also charges no monthly or opening fees and charges a low $10 fee for wire transfers if your account is below $25,000. The drawback is that they do not yet have online bill pay available, and you will not have a check book or debit card to easily access funds.

pros

cons

Rates

1.85% APY as of November 2018.

Barclays Online Savings

Features

Barclays requires no minimum balance for it's savings account and no monthly maintenance fees. It still manages to offer 2.05% APY. Just be aware of when you'll need to withdraw your funds. Deposited funds are held for 5 business days before you can make a withdrawal on them.

pros

cons

Rates

2.05% APY as of November 2018.

Citizens Access Savings Account

Features

Citizens Access not only impresses customers by being completely fee-free, they also have one of the best money market rates in the industry. The only drawback to the 2.25% APY is that your balance must be above $5,000.

pros

cons

Rates

2.25% APY as of November 2018.

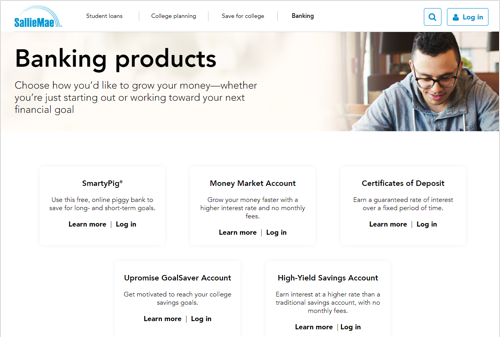

Sallie Mae Money Market Account

Features

Sallie Mae has a fantastic yield for those not needing quick access to their deposits. With a 2.12% APY and no minimum deposits or monthly maintenance fees, this is a great choice.

pros

cons

Rates

2.12% APY as of November 2018.

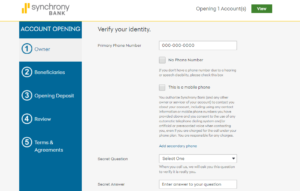

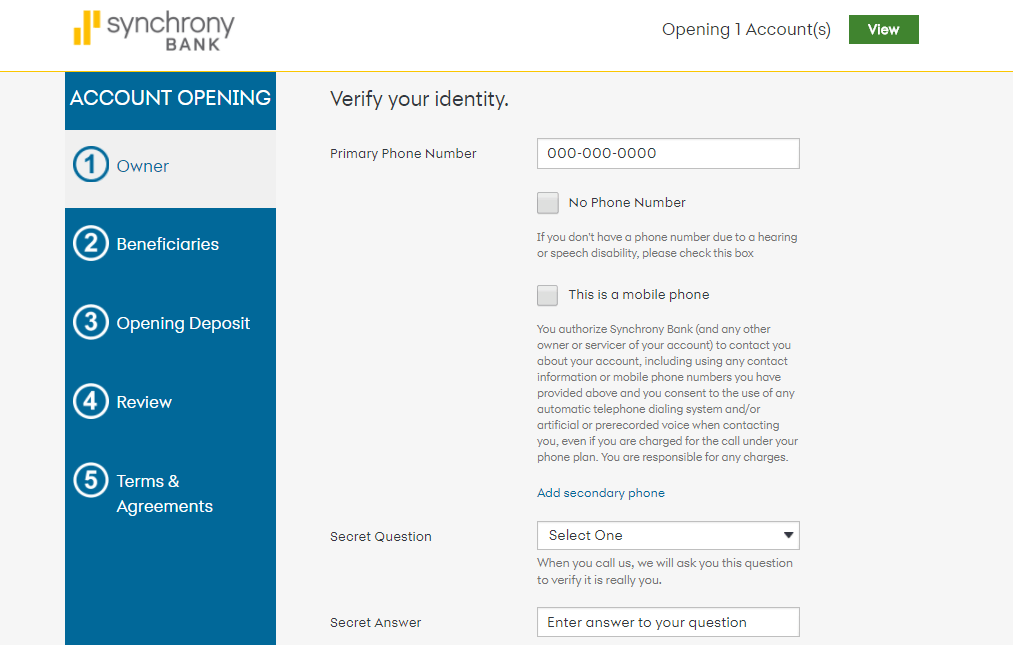

Synchrony High Yield Savings

Features

Synchrony has one of the best money market rates around. At 2.05% APY with no required minimum deposit or balance, this is one of the best options for a wide array of situations. There are also no monthly fees and ATM fees are reimbursed up to $5 each month. The only drawback is that there are no check-writing capabilities available.

pros

cons

Rates

2.05% APY as of November 2018.

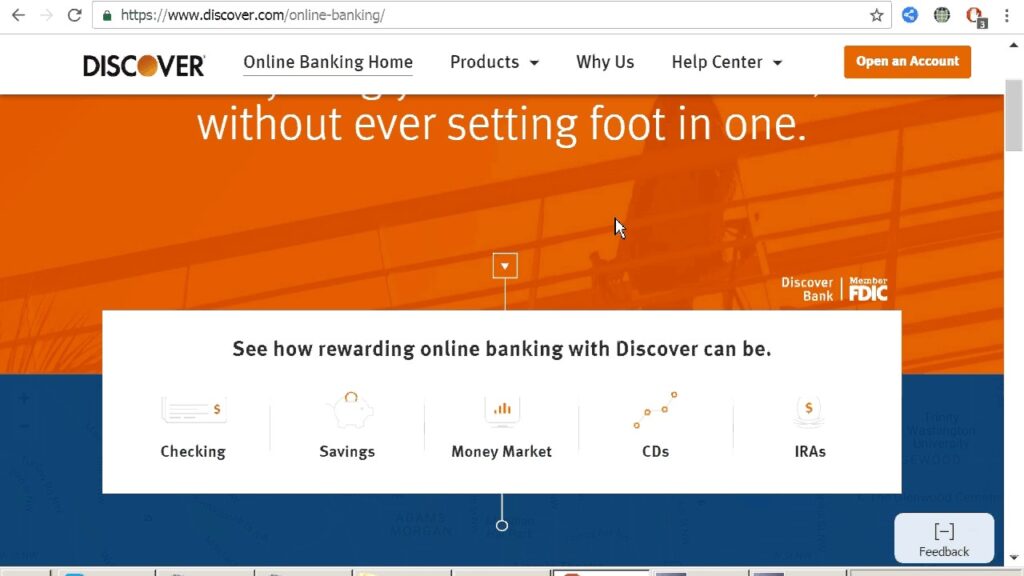

Discover Bank Money Market Account

Features

Discover Bank offers a solid yield for it's money market accounts. They will waive the first qualifying fee you encounter each year, and you will not have to pay any monthly maintenance fees if you maintain a balance over $2,500.

pros

cons

Rates

1.70% APY for balances under $100,000 and 1.80% APY for balances over $100,000 as of November 2018.

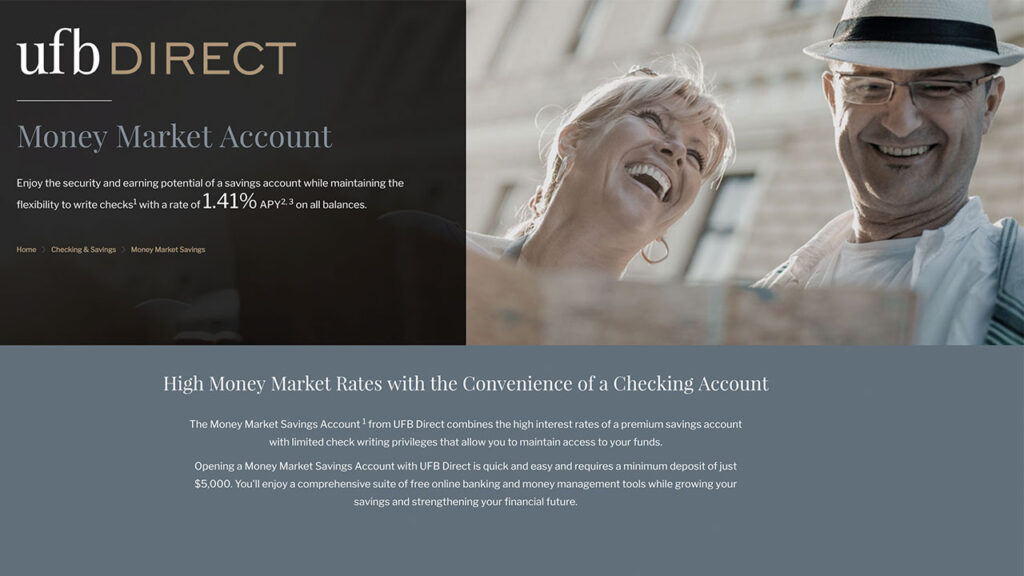

UFB Direct Money Market Account

Features

If you're looking for easy mobile, online, and debit card access along with check-writing capabilities, UFB's Money Market account is a good choice. The APY is not the highest available, but the ease with which you can access your account often makes up for that. However, this is not a good option for those looking to receive paper statements each month. You will pay $60 through the year to have paper statements mailed to your home.

pros

cons

Rates

1.60% APY as of November 2018.

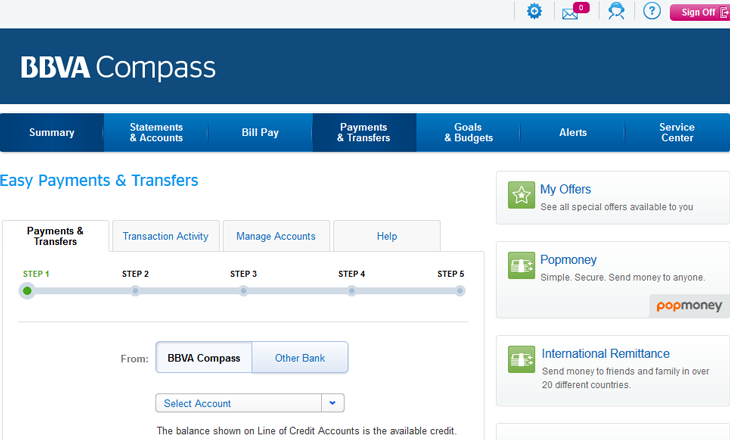

BBVA Compass Money Market Account

Features

BBVA offers decent interest rates for brand new money market customers. However, current BBVA customers with other types of accounts are not able to take advantage of these rates, instead receiving a dismal 0.05% APY for most money market balances. BBVA also charges excessive fees, including no limits on daily overdraft fees.

pros

cons

Rates

1.80% APY as of November 2018.

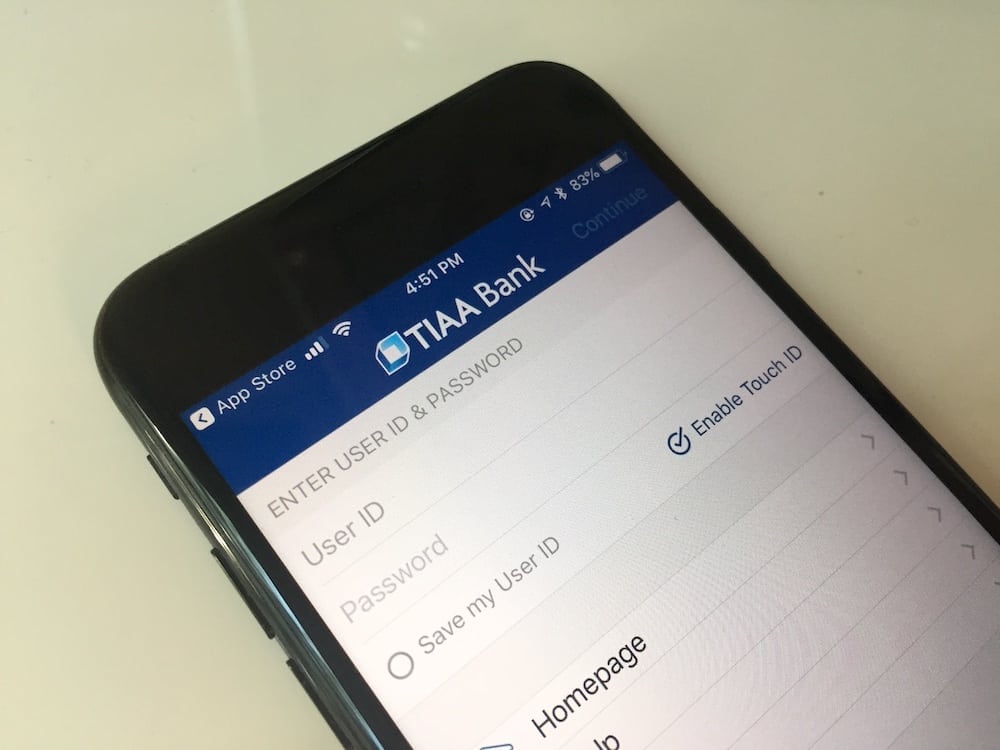

TIAA Bank* Money Market Account

Features

TIAA offers a money market account through EverBank. EverBank promises to offer yields that are in the top 5% of its competitors. However, these rates drop dramatically after the first introductory year, when the fixed promotional rate returns to a normal variable rate. If you are using the account as a temporary staging vehicle and plan to withdraw the money within a year, this could be a great option.

pros

cons

Rates

2.15% APY for the first year. Following year returns may be as low as 1.10% APY. Rates current as of November 2018.

The Verdict

The best money market rates are above 2.00% APY as of November 2018. If interest rates continue to rise, these rates will likely go up as well. Currently, Citizen's Access is perhaps the best choice for most people looking to stash $5,000 or more away for a brief while, or if they are looking to make sure their funds are not significantly damaged by any future economic downturns.

Not only is the 2.25% APY the best around, they also refrain from charging excessive, hidden fees, as some other institutions are prone to do. This means you can save your money with the peace of mind that you will not be nickeled and dimed in the process.

Additional Recommendation you might be Interested In

Last update on 2021-03-24 at 18:50 / Affiliate links / Images from Amazon Product Advertising API

Leave a Reply