What do Navy Federal mortgage rates look like right now? It's what anyone who has an account with this credit union might ask when they are looking to buy a home, build a home, or refinance the home they already own. Mortgages are expensive. A home is typically the most expensive purchase a person will make, and the rates you pay for your mortgage make it more expensive or more affordable.

Many people choose to work with a credit union for the simple fact that this is a lender with a little more leniency with their customers. Credit unions are more personal than a traditional bank. They are not for profit, so they work to ensure that their customers get the best rates, the most return on their money, and the best mortgage offers on the market. So, what do Navy Federal mortgage rates look like right now?

That's a question that comes with a different answer depending on the day. At the moment, mortgage trends are trending because the rates often change with the beginning of a new year. It's time to learn what you can expect from rates if you want to buy or refinance.

About Navy Federal Credit Union

Navy Federal Credit Union was founded in 1933 with a grand total of seven members. As of 2018, the credit union consists of more than eight million members. The credit union does not accept just any member, either. You must be a person who was enlisted in the military, is enlisted in the military, or the immediate family member of someone enlisted in the military.

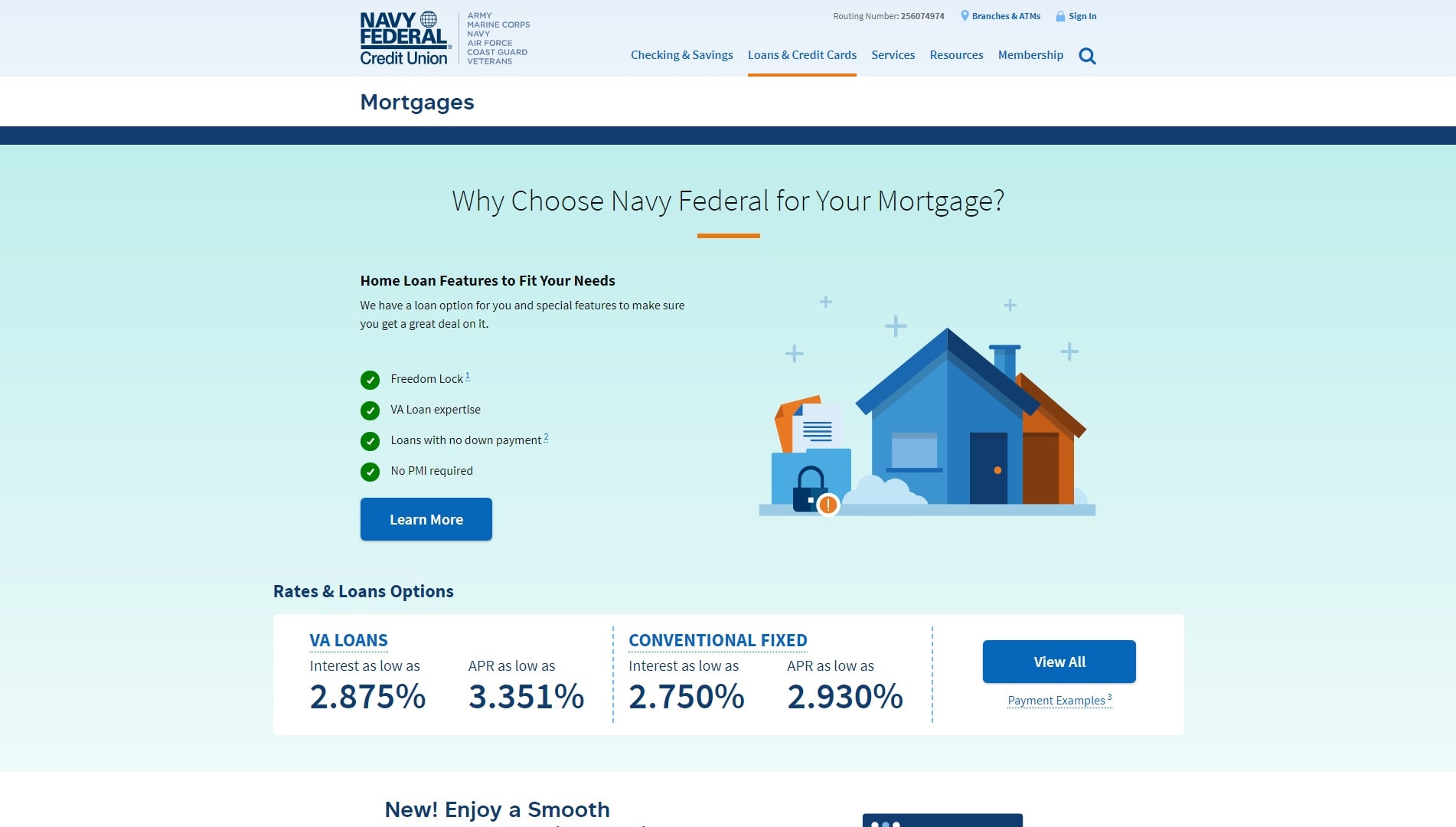

Image via Navy Federal Credit Union

The idea is that once you are a member of the military, you are always a member of this banking family whether you leave or retire. Your family is also a member because they sacrifice someone they love. It is a simple concept.

What Does Navy Federal Offer Members?

If you are in the military or you are the family of someone who is or was in the military, there are many banking options for you available at Navy Fed, including:

In addition to these things, you can also find many services with this lender:

These are just a few of the many things that Navy Fed offers their members. The credit union is one of the largest credit unions in the country, and they work to ensure that their members are given access to the best services in the country, which is what makes them such a reliable and trustworthy lender.

NFCU Pros & Cons

Navy Federal mortgage rates change along with rates all over the country, but there are some pros and cons associated with banking with this lender. If you're interested in a membership or a loan with the company, you should know what the pros and cons are.

The Cons Of Navy Federal Credit Union

While Navy Federal mortgage rates are some of the most competitive in the lending industry, there are a few things that might work as a con rather than a pro depending on what you are looking for. The biggest con is that you are not eligible to become a member of this credit union if you are not or were not a member of the military or the immediate family member of someone who was in the military. This can be a sibling, parent, grandparent, or child (biological, step, adopted).

The other con that many customers find upsetting is the savings APY. It's traditionally higher than that of a typical bank, but it's often lower than the APY that comes with savings accounts with other credit unions. Members often complain that they find their savings APYs are not as good with Navy Fed, which is a drawback for many. Fees are another drawback for many members. If you have a Flagship account, you have to maintain a $1,500 balance in the account if you hope to avoid paying a monthly fee.

Image by PhotoMIX-Company via Pixabay

Other credit unions make it a point not to charge fees to their members on these accounts. If you're in the market to open an account with Navy Federal Credit Union, do yourself the favor of going through the reviews associated with the accounts you're looking to open. Most people are satisfied with their service, but there may be some minor issues that make you think twice about opening certain accounts.

The Pros Of Navy Federal Credit Union

One of the biggest benefits of opening an account with Navy Fed is the sheer number of account options and the benefits of those. You can open education savings accounts, SaveFirst accounts, and much more. These accounts allow you to set your own maturity dates, earn money, and compound interest. They are some of the best accounts around, and that makes them more exciting than other accounts.

Another major benefit of becoming a Navy Fed member is the loan program they offer. This is a lender that makes a big point to be the best of the best. Navy Fed offers the best rates, the most competitive lending market, and more. Not only do they change their rates with the market fluctuations, but they also make sure to keep their rates as low as possible. This means Navy Fed often has the best rates to offer their customers, which is what makes so many people excited about becoming a member of this exclusive credit union.

Navy Federal Mortgage Rates Trend

Image by nattanan23 via Pixabay

Navy Federal mortgage rates tend to trend to the lower aspect of any loan on the market. The adjustable-rate mortgages offered by this credit union are among the best in the industry, and the rest of the rates on other mortgage options are just as low in comparison to other lenders. The good news with this company is that they offer the best rates in almost every category.

Rates Are Always Listed

What makes the Navy Federal mortgage rates so good is not just the rate, either. It's the fact that this lender lists them openly on their website so you can see what you're working with. They don't make a comment about “rates starting at this amount,” and leave it there. The precise rates for every single loan are listed for customers to see, and so are the discount points necessary to obtain a rate that low.

There Is An Origination Fee

Every loan you take with Navy Fed comes complete with a 1 percent origination fee. This is something you should consider when you apply for a loan with the company, but it's not that uncommon with other lenders. Just know what fees you're paying upfront.

The Loan Offers Are Unmatched

Image by AlexanderStein via Pixabay

You're going to find that Navy Federal mortgage rates are good, but you'll find that the variety of loans offered is even better. You're going to get jumbo loans, traditional loans, government-backed loans, and more. You will also find the lender offers loans without PMI even if you don't make a down payment that brings the total value of what you owe on your new home below 80 percent of the total home value.

Mortgage Match Guarantee

One more thing you should know about Navy Federal mortgage rates is that they sometimes rise, but it's not always a problem. If you find another mortgage rate that is lower with another lender, Navy Fed will match that rate. If, for some reason, the credit union cannot match that rate, they will offer you $1,000 in cash. They want to make sure they are getting their members the best of the best.

Navy Federal Mortgage Rates

It's impossible to pinpoint what happens with the rates at Navy Fed on any given day. When the Federal Reserve raises rates, the banks and lenders around the country do the same. The good news is that no matter how the rates are trending, Navy Fed has a long history and reputation of keeping rates lower than other lenders. They are looking to keep their members happy and feeling good about their financial situation, and that makes them work hard to keep that up.

Conclusion

Image by ErikaWittlieb via Pixabay

Navy Federal mortgage rates are impossible to predict. When the market fluctuates, the Federal Reserve makes judgments that affect rates across the board. Fortunately, this is one credit union that almost always offers lower rates than the competitors. Most credit unions offer lower rates on almost every loan they offer whether it's a mortgage, a refinance, a car loan, or even a personal loan or credit card. Whatever product you need, you'll find that Navy Fed has some of the most competitive rates on the market.

If all you need is a new account, you will still find that Navy Fed offers the best rates and options. If you're able to become a member, you should take advantage of that. Not many people can say they are eligible, so ask your loved one for a sponsorship so they can get you in to take advantage of these great rates and the products Navy Fed has to offer.

Featured image by Jessica Bryant via Pexels.

Leave a Reply