The Home Equity Line of Credit or the HELOC, as it’s otherwise known, is a type of home loan. It essentially allows the loaner to open a line of credit with his house being the collateral. It’s a good option for people in need of a larger sum of money, but borrowers need to be careful when handling it. In case you cannot make the payments as specified in your agreement, the lender is allowed by law to force you to sell your house to pay back all the money. Here is your simple guide to a home equity line of credit that will help you manage it.

How is a home equity loan different from other home loans?

There are several aspects under which the home equity loan differs from traditional home loans. The home equity line of credit rates comparison shows how, first of all, the HELOC is a simple credit line that lets the loaner borrow a certain amount of money, up to a pre-determined sum, usually set by the lender. With conventional mortgages, the amount you borrow is the total financed amount.

This is what basically makes the HELOC a credit card. It has a revolving nature, just like a credit card does. When you open either, the lender, which can be a bank or any other financial institution, sets up a maximum amount which you can use. Let’s say, for the sake of this argument, $10 000. You will not be required to pay any interest on this amount. You can use as much of this sum as you want. You can use $1 or the entire $10 000. There are no limitations regarding how you use it, when or if you use it.

This is what makes the HELOC such an attractive option. You can opt to not use the money, and even if you do, you don’t have to pay any interest at all. You simply put back, on a monthly basis, the exact sum which you used.

The HELOC is different from a Home Equity Loan as well. With the latter, you receive an amount, and then have to comply with monthly payments, which are fixed. They are usually set taking into consideration the amount you borrowed. The HELOC gives you complete freedom both in using the money and in paying them back.

What are the terms of a Home Equity Line Of Credit?

Such a loan normally has a term of 25 years. It also comes with draw and repayment periods. The draw is made up of the first 5 to 10 years while the repayment takes up the following 10 or 20 years. While still in the draw period, you can borrow as much as you like, as long as you stay within your allotted amount. Building on the example above, if your allotted amount is $10 000, that’s the maximum you can take out.

What is the interest rate of a HELOC?

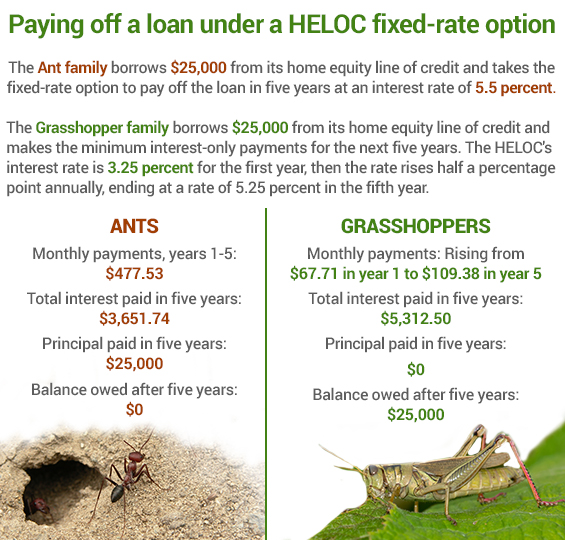

As far as home equity line of credit rates go, this type of credit line does not have a fixed rate. The lender will calculate it for your using the average daily balance, the prime rate, and the margin, set by him as well. The majority of lenders will grant you prime rates with zero margins. Sometimes, you can receive even less than prime. You might have seen less than prime offers in the shape of ‘prime -1%.’ However, you need to be aware that this is merely an introductory rate and that the lender will increase it as time goes by.

Regarding the prime for this line of credit for home equity, its current value is 3.25%. This means you need to be careful about the margin. Simply put, the higher the margin, the worse the deal. For example, if your margin is 4%, coupled with a 3.25% rate, it amounts to a total of 7.25%, which is not desirable at all.

Once your draw period is over, the repayment one begins. This is when you have to give back all the money, usually in the form of monthly payments. A crucial thing to remember here is that some lenders do not offer this option, which means you need to ask first. These lenders will ask for a full refund once the draw period is over, so you might find yourself having to pay a big amount of money in one go.

Can the HELOC serve as a second mortgage?

Yes, it can, and it usually does. That’s because it has been set up as a line of credit that stands behind the primary mortgage. Their main purpose is to fund payments for other credit cards or revolving loans, for home renovations or different types of household costs. However, this doesn’t mean it cannot be used as a first mortgage. It is, and some borrowers do use it like that, but it’s quite uncommon. The main reason it’s so uncommon is that it’s risky.

As stated in the beginning, unlike other types of loans or credit lines, the lender that granted you a home equity line of credit is completely entitled to ask you to sell your house to pay back the money you owe them. That’s because the contract you sign clearly stipulates your house is a collateral in this type of monetary transaction. In other words, when the lender agrees to give you the money, he needs a kind of reassurance that he will receive the amount back. Indeed, you are expected to pay your monthly installments, but if you are unable to, he asks you to put your house down for it. Upon signing, you agree to that. And, evidently, many homeowners find this transaction far too risky to be used as a primary mortgage.

In case you are thinking of applying for a Home Equity Line of Credit, you should know that most banks offer this option. Start your research on their websites and then contact them personally. A specialist will get in touch with you immediately and answer all your question. You can also search online for calculators that will give you an inkling of the sum of money you can receive and the monthly installments you will have to pay.

Leave a Reply